We cover cryptocurrencies, tokens, NFTs, metaverse and other web 3 income.

We get the tough technical bits right with a service you can trust.

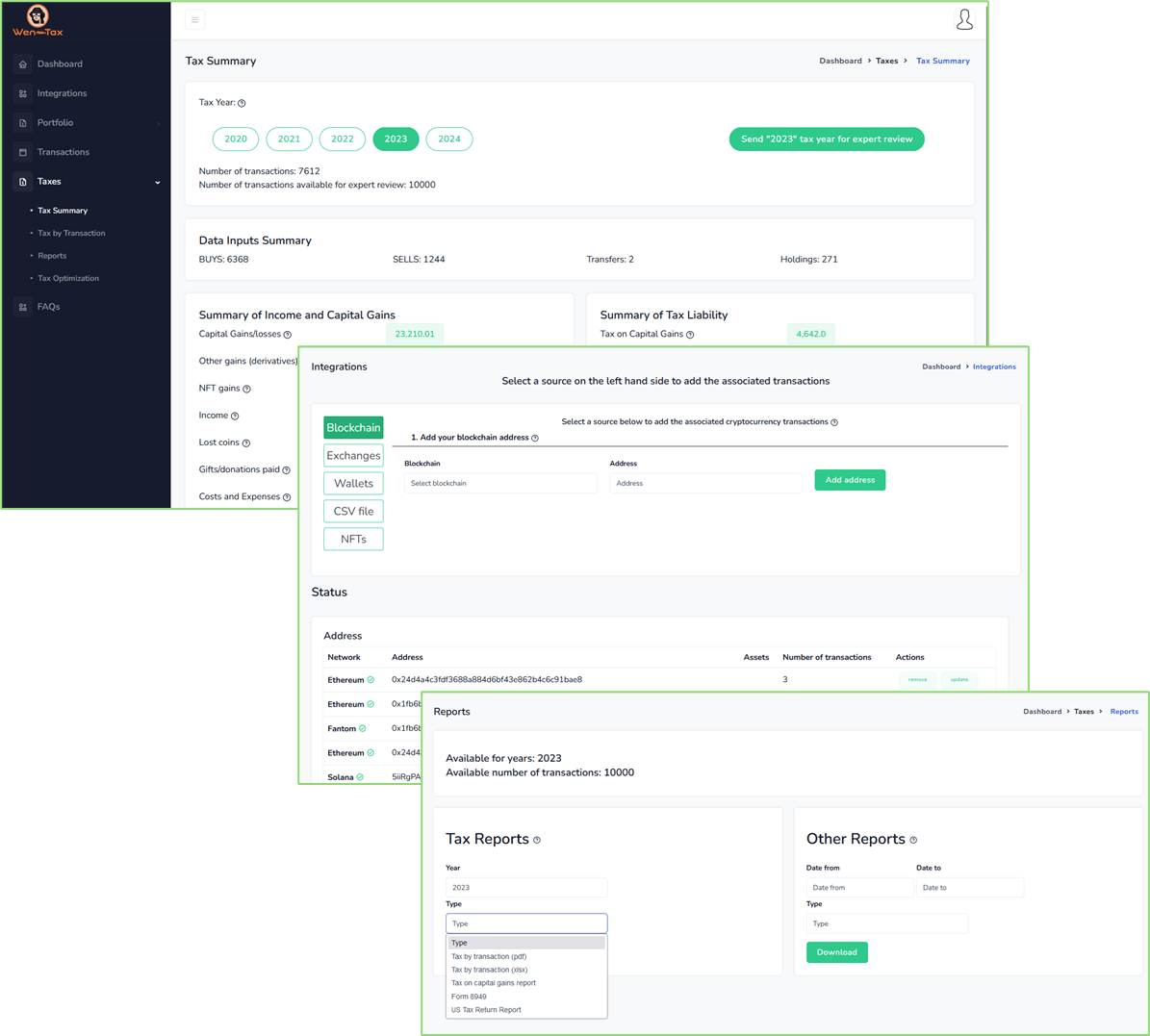

APIs and automation means you never need to work hard again to do your taxes.

We work with many of the Web 3’s top exchanges, wallets, businesses, and blockchains.

Your data is safe with us and we don’t compromise on your privacy or security.

We provide the data you need, from historic analysis of returns to portfolio optimization and tax optimization.

We do both cryptos and NFTs for a true all-in-one service.